Ushering in a new era of innovation, it is no secret that organisations must embrace a digital-first mindset to thrive in new business environments fraught with unprecedented challenges. Yet, due to the lack of robust digital adoption, leaders face a structural gridlock bound by accelerated industry transformations.

However, for financial institution, Finaxar, this is not the case.

The Singapore headquartered business sought to navigate the uncertainty of the pandemic by boosting its digital capabilities, while remaining cognisant of the changing market and customer expectations.

With the growing customer demands for quicker, hassle-free and contactless business transactions, there was a need to implement robust digital systems and harness capabilities to support these experiences.

Finaxar was able to scale its business and empower its workforce of the future by adopting IT strategically and integrating technologies from external vendors.

“COVID-19 helped us refine our focus on what matter most: Digitising SME finance. With the accelerated proliferation of B2B e-commerce, we recognised the need for SMEs to have digital payment capabilities and access to working capital,” said Finaxar's Group CEO, Tan Sian Wee.

Finaxar’s transformation began with developing a clear innovation strategy that meets business-growth targets and strategic objectives. “It is important that teams first identify the gap between actual and aspirational performance. For Finaxar, it was the lack of flexibility, ease and speed that was holding back its scalability,” said Tan.

Describing the challenges faced, he said that there was great pressure to better align the business transformation from its conventional lending processes to a complete SME digital payment and cash management solution. This included the need to simplify approvals from clients and internal staff for faster sales and support throughout. As such, this presented a great opportunity for the organisation to enable full automation of on-the-ground processes to expedite contracts and grow the business.

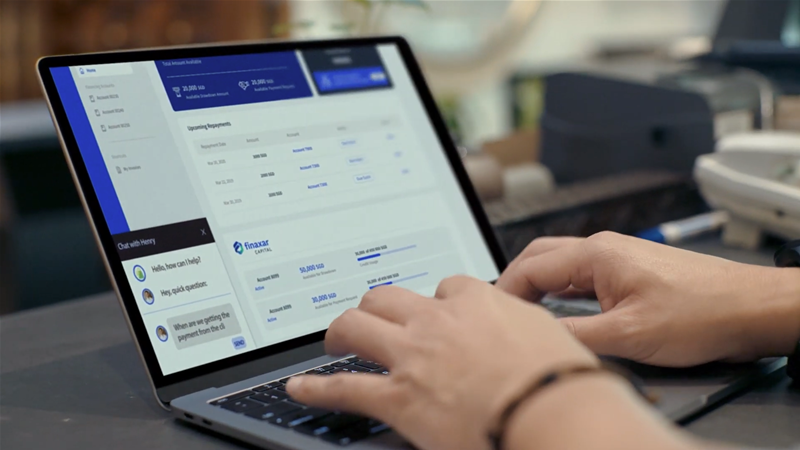

Finaxar launched Flex, a solution that helped smaller companies to manage payments and access capital on demand. “We made a conscious decision to extend our value proposition to support SMEs with their cash flow management needs with Flex Visa Cards. This required us to set up new processes, and we were able to leverage partners like DocuSign to support our new business requirements. This created a faster payment gateway that is credible and transparent, unlocking faster growth value for SMEs,” said Tan.

Embracing business agility

Through the investment of unique technological features such as e-signature and cloud-based agreements integrated into Flex’s app, its employees were able to seamlessly manage day-to day stakeholders.

More time was saved with the automation of templates and real-time accessibility of forms where data was input directly from their CRM systems. Through the strategic incorporation of agile and lean practices, Finaxar was able to scale its business rapidly and empower its digital workforce of the future.

As a result of going completely digital, Finaxar was also able to fully automate the process of customer registration to onboarding. With the help of DocuSign, it was also able to seal business deals faster, improving business productivity and exceeding its launch sales target by 50% respectively.

Finaxar’s SME clients were able to expedite contracts faster which unlocked quick access to working capital which allowed customers to procure their supplies today and pay 35 days later. This has translated to a seamless, trusted and user-friendly experience for both customers and employees.

Building enterprise-wide resilience

With hybrid working here to stay, the blended model has meant that businesses have had to adapt at a fast speed to stay afloat. A robust digitisation strategy has since become top priority for many leaders who realise they must evolve to maintain competitive advantage.

“Digital is an enterprise-wide change programme and we were not able to execute this without our trusted vendors for their agreement cloud solutions,” explained Tan.

“By focusing on building a fully digital core for all of our operational processes from marketing to sales, credit analysis, and operations with constant feedback to our product team, we are able to rapidly expand our business offerings targeted to meet the needs of our customers. With the cloud system, both ourselves and our clients are empowered to innovate their business solutions with greater flexibility.

“Internally, by harnessing digital transformation, we have integrated effective work practices, unlocked greater collaboration and created an open and clear work environment. This has resulted in breeding a growth culture and high performance teams with the strategic digital counsel capabilities to better serve our customers,” he added.