When COVID-19 hit, there was a societal shift that brought everyone online for their events, education, work, shopping, and entertainment. Technology quickly became a necessity for us to continue with our lives during the pandemic, and to stay connected.

This brought forth a change for data centres as they acquired a utility-like status – backed by the adoption of Big Data, Industry 4.0, IoT, 5G, and cloud computing. All these requirements culminated in a surge in data storage and processing requirements as a result from the increased levels of remote working during the pandemic.

This increased need for data space quickly absorbed the available inventory in several leading markets, prompting new construction to meet the demand. The demand has resulted in backlogs, especially with large customers pre-leasing new data centres even before they are built.

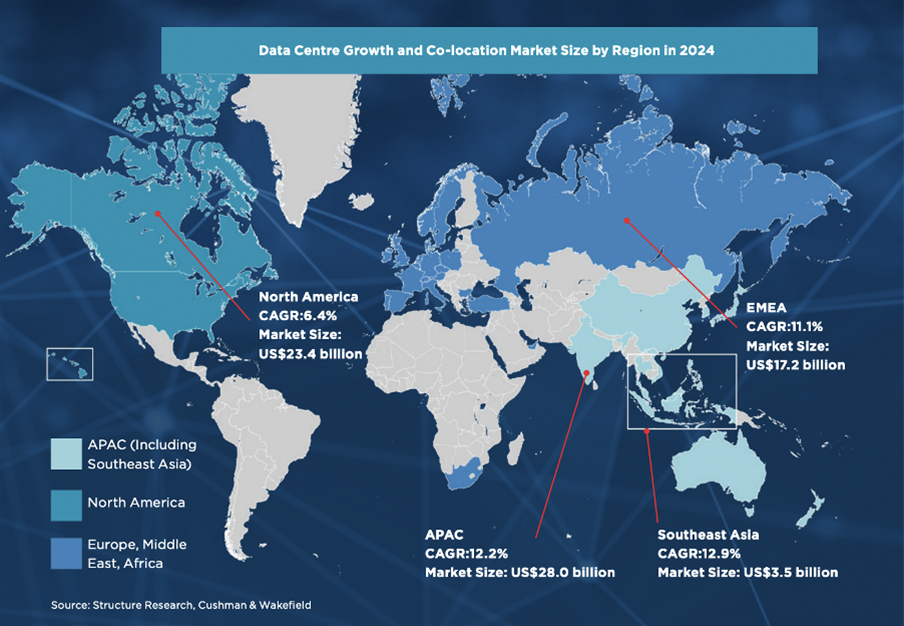

With the need for new data centres, the Asia Pacific (APAC) region is then seen as the prime market for data centre development. According to a report by Cushman & Wakefield, the expected compound annual growth (CAGR) of APAC is growing steadily at 12% CAGR over 2019 – 2024, with Southeast Asia (SEA) growing similarly at a CAGR of over 13% during the same period.

Pull factors of APAC

IT consumption on the ascendancy

The large domestic consumption, young demographics, and accelerating level of industrialisation amongst the SEA countries makes the APAC region appealing to data centre operators.

With the rise in affluence, and increasingly tech-savvy young population contributing to the increase in mobile usage in SEA, data centre providers would look to the region as an opportune region to bring data and cloud storage closer to the consumers - especially with the increasing usage of social media in the region, which will increase the demand for high-capacity storage solutions.

Furthermore, more than half the population in SEA is aged 30 and below, propelling technological advancements and innovations - all of which are best supported by managed data centre services.

With regard to SEA’s internet penetration rate which was only at 25% five years ago, it has since improved greatly to 65%. Approximately 415 million people in SEA can access the Internet, which was a huge contrast to the 380 million people just a year ago. Compared to the United States and the United Kingdom, which have rates of above 90 per cent, mobile usage in SEA, and by extension APAC, has huge potential for expansion.

The need for better IT infrastructure

The demand for high-performing IT infrastructure – IoT, AI, and big data analytics – is increasing. With more organisations adopting IT infrastructure into their operations to ensure their business continuity, this increased implementation would bolster the data centre market in APAC further – especially for that of hyperscale data centres as organisations want to ensure the scalability of their operations as well.

The explosive growth in digitalisation, e-commerce and digital banking in countries such as India, Indonesia, Thailand and Vietnam is likely to present opportunities for data centre operators in those countries.

We also have Vietnam’s long coastline that makes it a natural gateway and landing point for sub-sea cables to the other landlocked SEA cities. As sub-sea cables are developed in these markets, the second and third tier markets become more connected to the global marketplace as the data centres are now based in their home country.

The submarine cable deployment in Australia will also help boost facility growth, with the submarine fibre cable projects - INDIGO-Central and INDIGO-West - connecting Australia, Indonesia, and Singapore contributing to the increase in network traffic.

Sustainability of powering data centres

The pandemic had inadvertently given the world a glimpse of what a green future could look like for the world when the sweeping lockdowns across the globe forced people to remain at home. With data centres being widely known to consume a lot of resources, sustainability becomes a growing concern for operators.

As such, we find countries in APAC moving towards sustainable means of powering their data centres, and to cool them as well.

In Singapore, 7% of the country’s total energy consumption is derived from data centres, according to a local telco company. This figure is expected to increase to 12% by 2030, with Singapore accounting for 60% of Southeast Asia’s total data centre supply.

Regardless, Singapore remains at the top of Cushman & Wakefield’s Data Centre Competitive Index for APAC. With its increased efforts into providing cost-effective renewable energy supply, there are increasing investments in solar power deployment, and usage of hydrogen as an alternative fuel option.

Global tech giants - including Apple and Microsoft - helping with this endeavour. These two companies run their data centre operations in Singapore relying completely on solar power, according to a report from Digital Realty and Eco-business.

There have also been joint ventures in India between Adani Enterprises and EdgeConneX, and between GSPARX and NTT for a Malaysian data centre that reflects the efforts of countries in APAC to establish sustainable data centres.

APAC is now the leading market for data centres

The size of the Asia-Pacific market for co-location data centres is forecast to approach $28 billion by 2024, said Cushman & Wakefield. As a basis for comparison, this figure is 20% higher than the $23.4 billion forecast for North America.

The primary data centre markets that are expected to lead in the Asia-Pacific region are Singapore, Hong Kong, Sydney and Tokyo - with Singapore being the largest data centre market that accounts for the majority of the APAC data centre supply.

A contributing factor to Singapore being a popular location for data centre operators despite its land constraints and tropical climate could be its undersea cable connectivity. The comprehensive network of 24 undersea cables, as of May 2020, links Singapore to a multitude of key locations worldwide. This makes Singapore the prime location to connect the region to the rest of the world, and through to the rest of Asia.

Apart from Singapore, hyperscale cloud operators - such as Alibaba Cloud, AWS, Microsoft Azure, Oracle Cloud Infrastructure and Google Cloud - also increasingly gravitate towards data localisation.

Driven by a combination of regulations around cybersecurity, the e-commerce boom and ride-hailing industry, as well as on-demand access to cloud services by numerous local enterprises, more hyperscale data centres will be coming to APAC to set up their operations.

Over time, we might even see demand for data centres shifting to edge locations - such as secondary markets and smaller nodes in major cities - as architectures start to decentralise. This will boost the demand for colocation data centres in the secondary markets within APAC.