The APAC region is progressing well with the rollout of 5G, with government support being a key differentiator in how quickly a country can be 5G-ready.

Research by the Economist Intelligence Unit (EIU) across 16 APAC countries found that nine markets have either concluded 5G spectrum auctions or carried out commercial 5G launches, while some have even crossed the 50% mark in terms of 5G coverage as of March this year.

Government financial support was crucial in helping to support 5G networks and facilitating trials for industrial applications.

Sharing her views with iTNews Asia in an interview, Laveena Iyer, Research Analyst, EIU, said: “Prior to a launch, having a comprehensive nationwide 5G roadmap is very helpful for operators. After a commercial launch government support in the form of tax incentives, low-cost loans, direct investment helps operators as they work on network expansion.”

She said this support has also encouraged companies to improve network speeds, coverage and an increase in use cases for the enterprise sector.

Who’s ahead and who’s not in 5G?

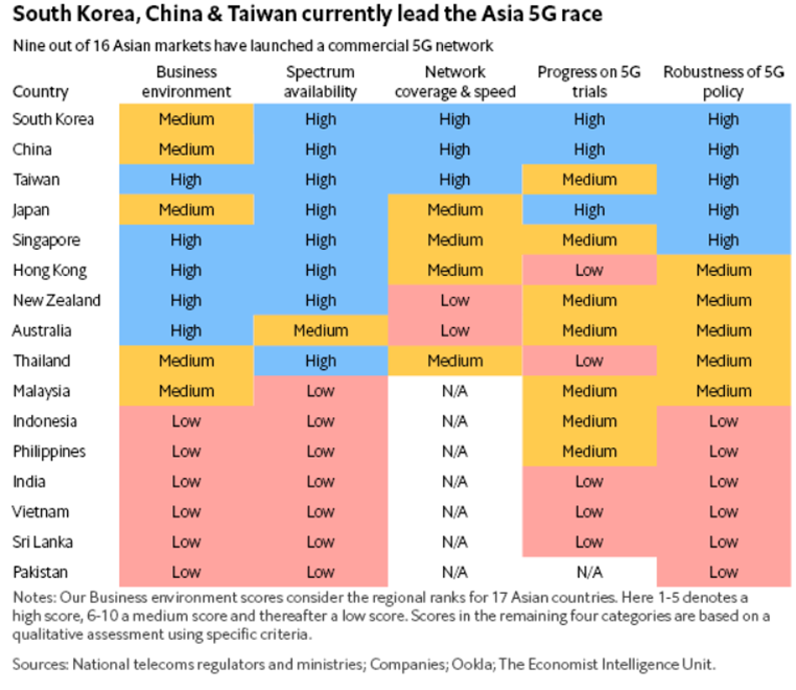

South Korea, Taiwan, Japan and China are most advanced in 5G; Thailand is progressing well; while India, Indonesia, Vietnam, the Philippines, Malaysia, Sri Lanka and Pakistan lag behind their regional peers, having not yet implemented a 5G policy.

In some of these countries, operators remain focused on improving 4G connectivity, such that any progress on 5G is only likely from 2022 onwards.

The 5G leaders in Asia

“A country’s ability to progress to 5G will largely depend on existing network infrastructure. Mature markets such as South Korea and Australia already had an over 90% 4G coverage. But Malaysia and the Philippines still clock under 80% in terms of 4G network coverage so operators in these countries will not be able to launch a 5G network until early 2022,” explained Iyer.

Looking ahead to 2021, she expects different markets in the APAC region will be pursuing very different goals and 5G implementation to remain uneven.

“On one hand countries such as Japan and Taiwan are moving towards expanding 5G network coverage beyond major cities and improving network speed.

“On the other hand, in India and Indonesia, operators still await a nationwide 5G policy, certainty over contiguous blocks of 5G spectrum, final decision on the base price, etc. The disparity over progress in 5G will continue to be seen in Asia during this year.”

Release of spectrum has enabled rapid progress

According to EIU, regulators in most Asian countries have been quick to release spectrum in the low 700 megahertz (MHz) band (suitable for covering large geographic areas, at the expense of speed) since 2019 for companies to test 5G. This has given regulators time to free up spectrum in the higher bands, which are capable of higher speeds, albeit over shorter ranges.

Spectrum in the mid 3.3(GHz)-3.5 GHz band and high 26-28 GHz bands has been made available in many markets, with most regulators providing smaller operators with an opportunity to acquire frequencies by setting affordable base prices.

Regulators in Australia and Hong Kong have been particularly helpful in setting low base prices. High spectrum costs have been a cause for concern for companies in India, where regulators and operators continue to spar over the base price. EIU expects operators in the country to explore fund-raising initiatives to help fund future spectrum auctions.

The disparity over progress in 5G will continue to be seen in Asia this year.

- Laveena Iyer, Research Analyst, EIU

What policies have worked in Asia?

- A comprehensive government policy towards 5G that covers all parts of the network ecosystem is favourable for faster expansion, reported EIU. For instance, guidelines to enable right of way and infrastructure-sharing enable companies to promptly launch a commercial network after spectrum has been assigned, as is the case in Australia.

China's telecoms ministry has played a crucial role in framing policy that helped companies reach a 700,000 5G base station rollout target by November 2020, despite the pandemic.

- Coverage targets, such as those set in South Korea, and tariff caps to ensure customers can afford new spectrum services, such as those in Taiwan, are favourable policies for 5G adoption.

- Most companies have identified the enterprise sector to be more lucrative for 5G than the consumer market in the short term. It therefore helps to enforce a detailed industrial 5G policy. An example is Singapore, where it has identified six industrial clusters as benefitting most from 5G: maritime operations, smart estates, Industry 4.0, government applications, consumer applications and urban mobility.

EIU’s recommendations

The Covid-19 pandemic has kept many Asian governments busy throughout 2020 and early 2021. As some of them shift their focus to 5G rollout, EIU recommendations recommends the following for governments in the region:

Spectrum: For the remaining seven Asian countries that have not yet released 5G spectrum, governments will need to focus on vacating the necessary bands that are currently occupied by other media or defence services. Making contiguous blocks of spectrum available is critical to network performance and speed.

Policy: Although operators have set aside funds for spectrum auctions, commercial launches and infrastructure expansion account for a significant portion of their capital expenditure.

Thus far, there has been little interest from private investors in co-owning a 5G network, which means that operators will have to rely on financial support from government.

Opportunities and risks

In EIU’s prognosis, the enterprise sector (most notably smart manufacturing, smart cities and edge computing) will offer the biggest growth opportunities for 5G. On the home broadband front, operators have been able to charge a similar tariff to that of fibre networks to retail customers, which is a new and previously unanticipated avenue for growth.

In terms of risks, consumer adoption of 5G mobile subscriptions is uncertain. Companies that have launched 5G have had to offer steep discounts or offer 5G packages as a complimentary service for a short-term period. EIU foresees that what would be a feasible price point for 5G is more likely to be determined as these promotional offers end in 2021.

“Setting up a 5G network is a capital-intensive exercise for companies. Retail adoption is expected to be slow in the short-term, but the EIU research showed that 5G-based home broadband is a segment that’s picking up pace in markets such as Australia and Hong Kong,” said Iyer.

“In some cases operators are able to charge the same tariff for 5G broadband as existing fixed broadband players in the market. So in addition to the enterprise sector, home broadband within the retail segment is a new avenue for growth.”