With increased digitalisation, especially in the financial and other sectors, the demand for jobs related to cryptocurrency, blockchain and NFTs (non-fungible tokens) is on the rise in Singapore.

It is not just financial institutions like OCBC and DBS Bank that are hiring technical expertise in these areas.

Research by the global job portal, Indeed showed that there was a growing number of positions requiring some knowledge in these areas, even in non-financial verticals.

Over the past two years, in addition to technical areas, some jobs in media, law and arts have also started demanding expertise in blockchain, cryptocurrency or NFTs, it said.

Indeed added that jobs requiring knowledge in blockchain, cryptocurrency or NFTs have grown 80 percent in Singapore during the past year.

The data also revealed an acceleration in market demand, especially in comparison to 2020, when the increase was 20 percent.

Anecdotal evidence supports this point about the rising demand for jobs requiring blockchain, cryptocurrency and NFT skillsets.

A search on LinkedIn jobs showed 1032 jobs requiring cryptocurrency expertise being currently advertised in Singapore and for blockchain expertise, the number is 2022.

A search for banking software-related jobs on LinkedIn showed 516 jobs being advertised currently.

Another popular job portal, Monster jobs showed similar results: 1009 jobs requiring blockchain expertise and 478 cryptocurrency-related jobs.

Indeed said that from January 2021 to 2022, the number of job titles that required knowledge of either blockchain or cryptocurrency almost doubled in Singapore.

It added that in 2019, most roles asking for blockchain or cryptocurrency expertise were technical, such as software engineers, developers and software architects.

By 2021, roles like compliance officers, community managers, recruiters, and social media specialists also included requests for knowledge in blockchain, cryptocurrency or NFTs, the research said.

Nishita Lalvani, senior manager at Indeed, Singapore, said the research identified two primary trends, “one a growing demand for technical professionals, like developers and software engineers, who have skills in these areas”.

The second is that “even for non-technical professionals, knowing about these technologies can become a differential to get a job”, she said.

“For these professionals, the level of expertise required can vary a lot, but it seems that some knowledge is already making a difference," Lalvani said.

The Singapore government has a nuanced position on cryptocurrency and blockchain.

Singapore’s central bank Monetary Authority of Singapore (MAS) “frowns on cryptocurrencies or tokens as an investment asset for retail investors”.

At the same time, MAS is of the view that blockchain and cryptocurrency tokens can bring “many potential benefits”.

According to the central bank, blockchain is best suited for applications where it is important to know the history of ownership and transfer of value while the potential “strong use case” of cryptocurrency tokens is to facilitate cheaper and faster cross-border payments and trade finance.

The government’s position may explain the demand for blockchain, cryptocurrencyand NFT skillsets in a wide range of industry verticals not directly related to the financial sector.

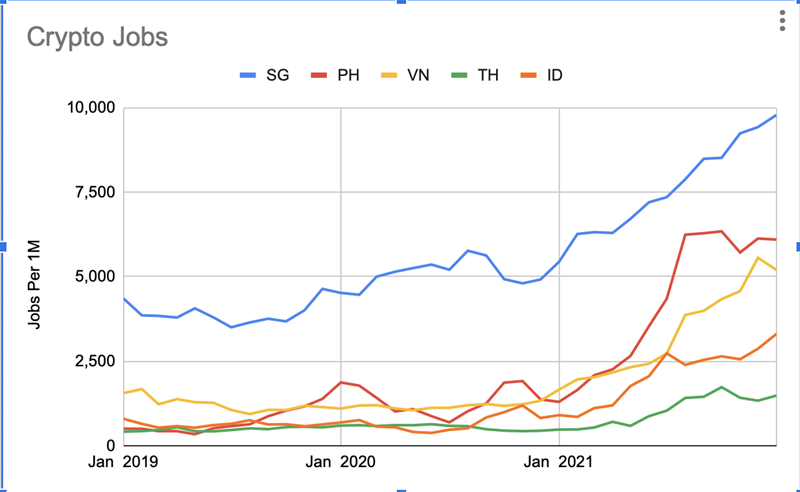

Lalvani said Indeed's research identified a similar demand for these skillsets in other countries in the region.

In the past year, the demand for professionals with these skillsets grew 370 percent in the Philippines, 213 percent in Vietnam, 211 percent in Thailand, and 266 percent in Indonesia, she said.

"Singapore is an Asian financial and technological hub. The country understands that these new technologies have the potential to disrupt several sectors of the economy and is investing to be at the forefront of the transformation,” Lalvani said.