Indonesia’s first public-listed technology unicorn, Bukalapak and Standard Chartered bank (StanChart) have launched a digital banking service to offer an “inclusive” experience to those living outside of major Indonesian cities.

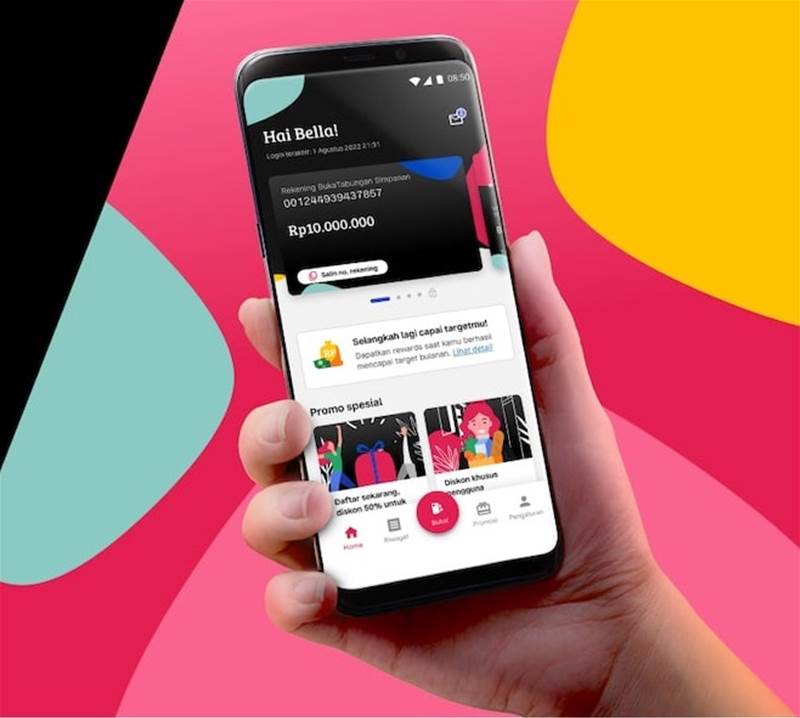

BukaTabungan, a service sitting on Bukalapak’s platform, will offer banking services to an ecosystem of over 110 million users and 20 million business owners, by offering a digital onboarding experience.

This follows an earlier announcement on their strategic partnership to launch innovative offerings focused on digital banking and to widen financial inclusion to the country’s underbanked segment.

Bukalapak’s President, of Commerce and Fintech, Victor Lesmana, said, “business owners now also have access to financial services to support their business from a reputable financial institution.”

This includes MSMEs (micro, small and medium enterprises), underbanked and unbanked people who have had difficulty accessing banking services, with sophisticated security systems and technology tailored to their needs, he said.

Lesmana added that users would also benefit from no administrative fees for savings, up to 20 free transfers and cash withdrawals, as well as higher interest rates on savings.

Hosted on StanChart’s nexus platform – a banking-as-a-service solution by the bank’s innovation and venture arm SC Ventures – it will offer benefits to its users, including the convenience of opening an account in as quickly as five minutes, according to the bank.

Using advanced automation and security technologies employing artificial intelligence (AI), biometric facial recognition and E-KTP (Indonesia’s biometrics-enabled ID programme) validation, opening an account on BukaTabungan is said to be “truly paperless”, the bank statement added.

This mobile application for digital banking service will have an "extensive network" that is easy to access and spread across Indonesia so users can deposit and withdraw their funds easily.

Funds deposited into this new mobile application for digital banking services will be managed by Standard Chartered. The digital banking service has received approval from Indonesia financial services authority Otoritas Jasa Keuangan (OJK).