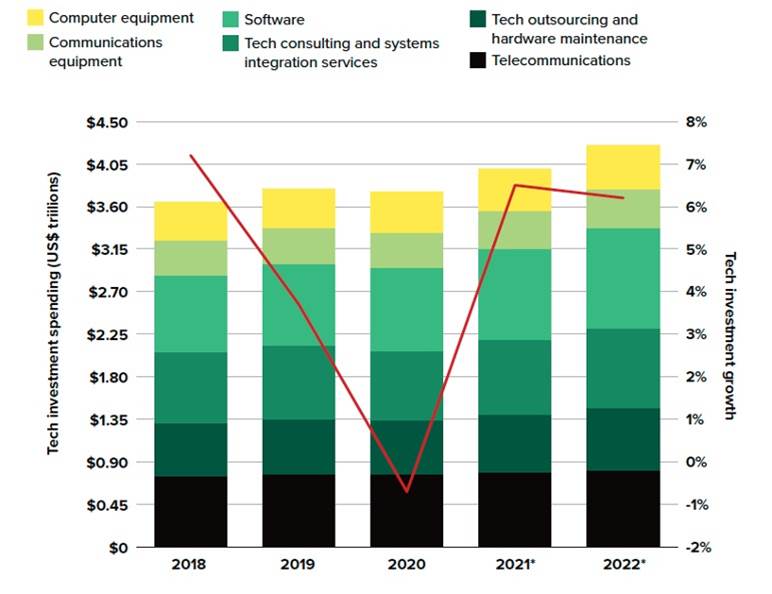

Global tech investments – flat in the pandemic recession of 2020 – are back on the ascendancy and projected to grow 6.5% this year and into 2022.

A peek into the Global Tech Market Outlook 2021-22 by analysts Forrester also revealed a healthy outlook for APAC, with one third of the share of growth coming from China, and spending growing close to the global average or 6.2% in 2021. APAC and North America were in fact the only regions that saw tech market growth in a much-dampened 2020.

Forrester said this growth will be led by software. While investments were hit hardest in 2020 as organisations curtailed noncritical investments to focus on work-from-home, productivity, and e-commerce application, software spending will become the highest growing segment for the next two years.

Forrester lists the top five growth segments in 2021-22 as:

- Software will grow by 10.1%

Cloud-based human capital management, ERP and customer service software applications will rebound this year. Pent-up demand to replace legacy software with cloud products will translate to higher software sales growth. Collaboration software will continue to also see robust demand.

- Tech consulting and outsourcing services will grow by 6.3%

The pandemic caused many firms to curtail new projects and renegotiate outsourcing deals. Investments in consulting, systems integration, outsourcing, and maintenance will rebound into positive territory.

- Communications equipment will grow by 5.8%

New spectrum allocations and the resumption of wireless network expansion will drive capital expenditures in the second half of the year.

- Computer equipment will grow by 4.0%

PC shipments will sustain their momentum, driven by the needs of hybrid education and office work environments.

- Telecom services will grow by 3.4%

Remote working, internal collaboration among teams, remote supervision and activity tracking will continue to sustain telco revenue growth. The pandemic also offered new opportunities for IoT applications to track the efficient and safe use of buildings as employees return to the office.

Speaking about the uptick in software spending, Himank Joshi, researcher at Forrester, said the increase in China, Australia, Singapore, Japan, and South Korea reflect similar trends to the US and Europe. But in other Asian countries, he said the underlying infrastructures for cloud software are still emerging, so on-premises software still remains important.

Across other areas, Joshi said: “In many countries, getting the fundamentals of PCs, core business applications, and basic networking is the main driver of tech investment. We see ample business opportunities, including integrated data cloud demand from the private and the public sectors, making it a long-term structural growth opportunity. The cloud computing market is benefitting from organisations migrating their workloads to digital formats.”

Predicting the growth drivers in APAC

Andrew Bartels, VP, principal analyst, Forrester, said growth in APAC is being led by the twin engines of software and IT services.

“The pandemic led to cutbacks of enterprise budget for new projects. In 2020 though, IT services companies were skewed towards outsourcing vs consulting. We expect this trend to reverse in the coming quarters as companies begin to recognise revenues from backlog projects and new deals,” he told iTNews Asia.

“We see software growth as bringing the momentum for IT services recovery in 2021 and consulting growth as having the greatest impact.”

Expect a healthy spending rebound in 2021

On the sectors adopting new technologies, Bartels said government and businesses in the advanced APAC countries are ready to embrace emerging technologies like AI, machine learning, IoT etc.

“We see governments and businesses continue to invest heavily on infrastructure modernisation, e.g. scaling 5G rollouts and building more data centres. China, Japan and South Korea have kept AI and robotics at the forefront of their national strategy as governments have been providing strong policy support,” said Bartels.

“Companies in the region also have a renewed focus on deeper integration between digital and real economy by development of a digital industry value chain and formation of a platform-based ecosystem to support growth in tech.”

Bartels sees Asia Pacific and North America as regions leading the global recovery, with China the most influential growth driver. A third of the tech spending in APAC comes from China, making it the largest tech market in Asia and second largest globally.

“For developing countries in Asia like India, Indonesia, Philippines, and Thailand, we have modelled recovery scenarios in 2022 based on year-over-year growth to be in the mid-high single digits range. However, we expect the growth to be uneven based on broader differences in macro-economic recovery trends and expected timelines by which their economic output will reach pre-pandemic levels.”