Intel on Tuesday said it plans to operate its programmable chip unit as a standalone business starting in January, with plans to hold a public offering for stock in the business over the next two to three years.

Intel shares were up more than two percent after the bell.

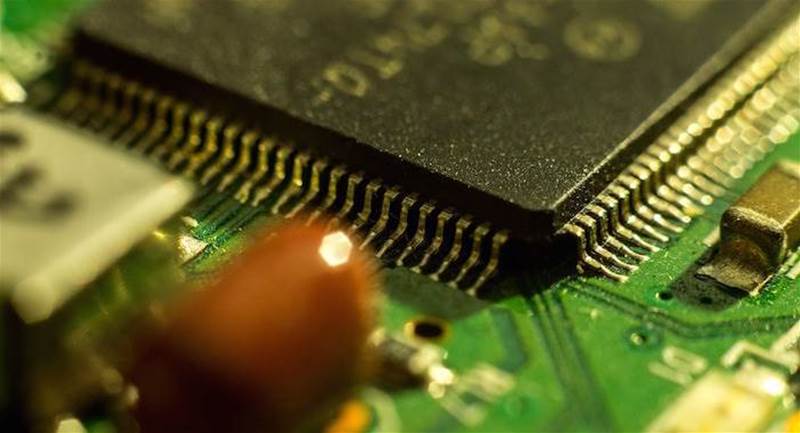

Intel acquired the business when it bought Altera for US$16.7 billion (S$23 billion) in 2015. Programmable chips sit between Intel's general-purpose chips and chips that are designed for a single task and used in everything from encrypting data to 5G wireless telecommunications equipment.

Intel said Sandra Rivera, an Intel veteran, will oversee the new unit, which will keep using Intel's factory to make its chips. Intel said it has started "an extensive internal and external search" to replace Rivera, who currently oversees the company's data centre and artificial intelligence chip business that competes with Nvidia and Advanced Micro Devices.

During a conference call with investors, Rivera said the unit is increasingly using Intel's factories rather than the factories in Taiwan where its chips were previously made. Programmable chips are used in defence applications such as fighter jets.

"We see enormous customer interest in a more secure, resilient supply chain in North America, and you could just imagine the industrial customers, the aerospace and defence base customers," Rivera said. "We're setting this up to really have a unique advantage by leveraging Intel."

The deal follows Intel's earlier moves to sell its memory chip unit to SK Hynix and take public part of its Mobileye self-driving car chip unit. Both efforts were aimed at streamlining Intel's business and drumming up capital for Chief Executive Pat Gelsinger's strategy to turn the company around by reviving its manufacturing arm, which had fallen behind rivals such as Taiwan Semiconductor Manufacturing Co.

"This seems like an overdue, smart, and effective move to potentially create more value for investors and allow Intel to focus on core competencies while raising funds for its turnaround attempt," said Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.