Southeast Asia’s banking landscape is poised for change, with regulatory policies encouraging digital challenges to enter local markets.

Since Singapore issued the first digital banking licenses to involve non-financial firms, countries like Malaysia and the Philippines have also followed suit, as other form of banking models are emerging.

The prospects for digital banking is positive as two-thirds of consumers here (66%) are already aware of digital banking with a similar number (67%) interested in adopting digital banking services, reported Visa in a Consumer Payment Attitudes Study conducted from August to September 2020 with 7,526 consumers aged 18 to 65 in Singapore, Malaysia, Thailand, Indonesia, Philippines, Vietnam, Myanmar and Cambodia.

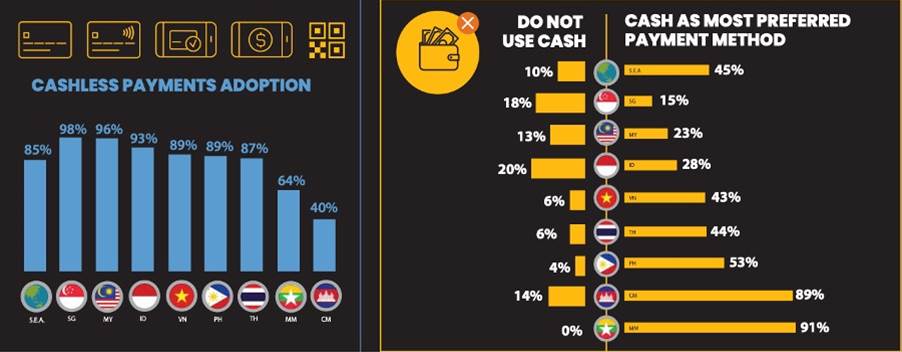

At the same time, with the pandemic, Southeast Asia countries is accelerating the shift towards cashless payments by three to five years, with Malaysia, Singapore and the Philippines at the forefront of this trend.

Cashless payments are rising

More than half of consumers (54%) in the region prefer digital payments in the survey. More than two in five (46%) consumers now carry less cash compared to before the pandemic, particularly in Indonesia (60%), Vietnam (56%) and the Philippines (53%).

In categories going cashless, bill payments (64%), supermarket purchases (56%) and taxis and ride sharing (52%) lead the way. Overseas travel (56%) is also the preferred payment mode when the industry recovers.

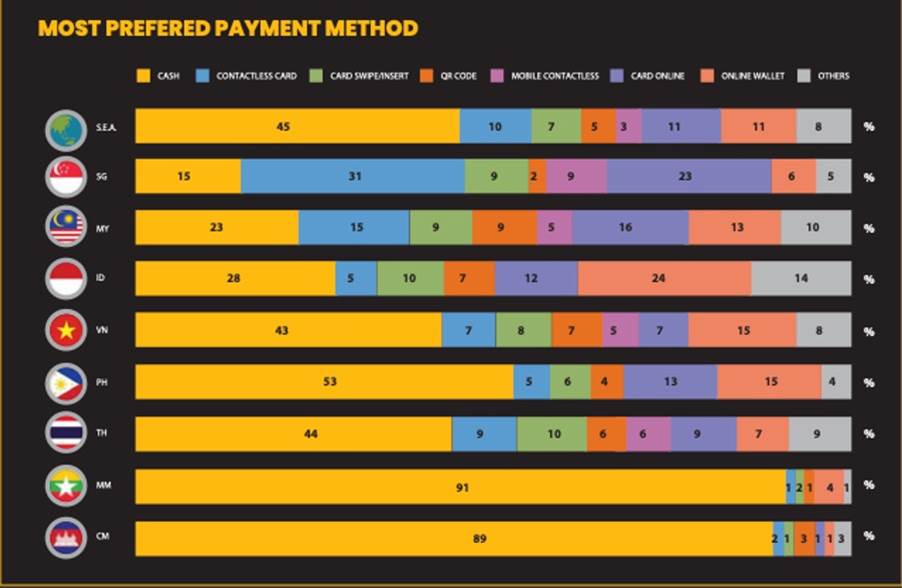

Payment preferences are diversified and the experience is still fragmented.

The payment preferences of consumers are diversifying as payment experiences become more fragmented. Consumers now have an abundance of choice, with more ways to transact and more places for commerce. In Singapore, contactless cards are most preferred (31%) due to widespread acceptance. In contrast, online wallets lead the way in Indonesia (24%) due to the multitude of e-wallet players.

“In Southeast Asia, nationwide lockdowns, movement controls and safe distancing measures is accelerating the shift towards digital-first experiences – particularly for payments and commerce.

“With the emergence of new payment experiences, digital payments are more accessible than ever, and consumers are likely to seek out more innovative ways to pay,” said Mandy Lamb, Group Country Manager, Regional Southeast Asia, Visa.